Washington SOC Code Update

The Washington State Legislature recently passed a law that requires employers to report Standard Occupational Classification (SOC) codes in their quarterly reports for unemployment insurance.

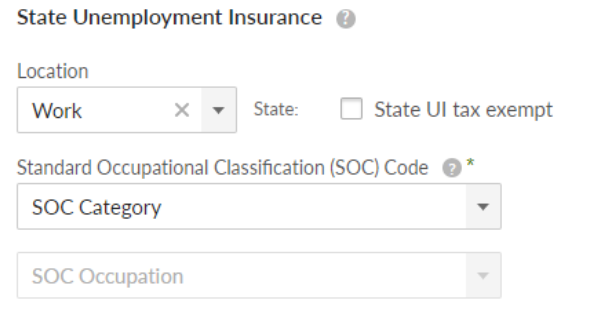

As a result, we’ve updated the ‘State Unemployment Insurance’ sections within BambooHR to include the following two selections:

- SOC Category

- SOC Occupation

The combination of these two selections will determine the associated six-digit SOC code that is reported on quarterly tax filings. The SOC Category provides the first two digits and the SOC Occupation provides the last four digits. This will be required information prior to an employee being included in payroll if their State Unemployment Insurance tax location is the state of Washington.

Customers will need to provide the SOC codes for all employees who were paid, or will be paid in the 2023 year and going forward, by January 31, 2023. Until that date employers are only required to provide SOC codes for new employees or employees with a State Unemployment Insurance tax location change to Washington. After January 31, 2023, it will be a requirement to provide this information for all applicable employees before opening payroll.

You can easily create a list of employees in the state of Washington by creating a custom report in your BambooHR account using the field ‘State’ under the Personal section and ‘Location’ under the Job Information section.

Included below are helpful links on SOC code definitions and guidelines:

- Washington State website information on implementing SOC codes

- List of Standard Occupational Classification codes and definitions

- Standard Occupational Classification coding guidelines

We hope you are as excited about this product update as we are. We are confident that it will make your job a little easier and set you free to do great work. If you are looking for more information regarding this update, make sure to check out these Help Articles that explains more about how to use this new update.